Post On: 2025-12-20 | Visitors: 310

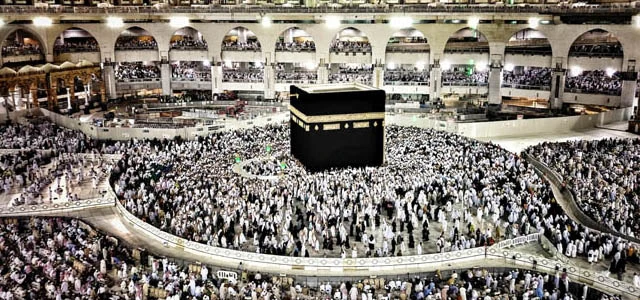

Planning for Umrah is a deeply spiritual process, but it also involves careful travel preparation. From booking flights and accommodation to arranging visas and transportation, pilgrims must consider many practical aspects. One of the most commonly overlooked yet important elements is travel insurance for Umrah.

Many pilgrims ask the same question: Is travel insurance for Umrah really worth it? The short answer is yes - but understanding why is essential. In this blog, we’ll explore what Umrah travel insurance covers, whether it’s mandatory, and how it adds value to your journey.

What Is Travel Insurance for Umrah?

Travel insurance for Umrah is a policy designed to protect pilgrims from unexpected events during their trip to Saudi Arabia. These events may include medical emergencies, trip delays, lost baggage, or other unforeseen circumstances.

Saudi Arabia now provides basic medical insurance with the Umrah visa, but this coverage has limitations. Additional travel insurance can offer broader protection, giving pilgrims greater peace of mind.

When planning your pilgrimage, it’s important to view insurance as part of your overall travel arrangement - just like flights, hotels, and local support, which are usually included in comprehensive Umrah Packages.

Explore complete pilgrimage solutions on the Umrah Packages main page.

Is Travel Insurance Mandatory for Umrah?

Yes, basic insurance is mandatory and is automatically included with the Umrah visa issued by Saudi authorities. This insurance generally covers:

- Emergency medical treatment

- COVID-19 related care (if applicable)

- Some hospital expenses

However, this government-provided insurance:

- Has limited coverage

- Does not cover trip cancellations

- Does not include baggage loss or flight delays

That’s why many experienced pilgrims choose to purchase additional travel insurance for enhanced protection.

What Does Additional Umrah Travel Insurance Cover?

A comprehensive Umrah travel insurance policy can cover a wide range of scenarios, including:

1. Medical Emergencies

While basic visa insurance covers emergency care, private travel insurance often includes:

- Higher coverage limits

- Access to better hospitals

- Coverage for pre-existing conditions (in some plans)

2. Trip Cancellation or Interruption

If your Umrah trip is canceled or cut short due to:

- Illness

- Family emergencies

- Flight disruptions

Travel insurance can help recover non-refundable costs.

3. Flight Delays & Missed Connections

Flight delays can affect hotel bookings, transport, and Umrah schedules. Insurance may compensate for:

- Extra accommodation

- Meals

- Rebooking expenses

4. Loss of Baggage or Documents

Losing luggage or important documents during Umrah can be stressful. Insurance can help cover:

- Replacement costs

- Emergency assistance

Is Travel Insurance Worth It for Umrah Pilgrims?

For most pilgrims, yes, it is worth it. Here’s why:

- Umrah involves international travel

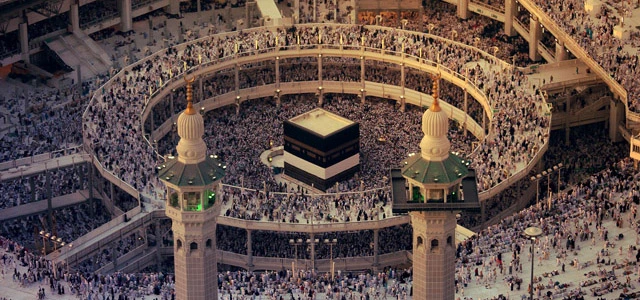

- Pilgrims often include elderly family members

- Crowded environments increase health risks

- Unexpected events can disrupt carefully planned trips

Travel insurance acts as a safety net, allowing pilgrims to focus on worship rather than worry.

If you’re traveling from India - especially from major cities like Delhi - well-organized travel support combined with insurance can make a significant difference.

Learn more about region-specific travel services on Umrah from Delhi and other cities.

Travel Insurance vs Group or Package Coverage

Some pilgrims assume that booking an Umrah package means insurance is unnecessary. While many packages include basic coverage, they may not offer:

- Personal medical coverage extensions

- Baggage protection

- Trip cancellation benefits

That’s why it’s important to understand what your package includes and where additional insurance may help. Trusted travel providers clearly outline inclusions and assist pilgrims in understanding their coverage.

For clarity on what’s included, visit the Umrah FAQ / Frequently Asked Questions page.

Who Should Definitely Consider Additional Insurance?

Extra travel insurance is highly recommended if you:

- Are traveling with elderly family members

- Have existing medical conditions

- Are traveling during peak Umrah seasons

- Are booking non-refundable flights or hotels

- Want coverage beyond basic medical emergencies

Even healthy travelers can face unexpected delays or disruptions, making insurance a smart investment.

How Much Does Umrah Travel Insurance Cost?

Compared to the overall cost of Umrah, travel insurance is relatively affordable. Most policies cost only a small fraction of:

- Flight tickets

- Hotel stays

- Package expenses

Yet the financial protection it provides can be significant in emergencies.

Tips for Choosing the Right Travel Insurance for Umrah

- Ensure coverage is valid in Saudi Arabia

- Check medical coverage limits carefully

- Look for 24/7 emergency assistance

- Confirm coverage for trip cancellations and delays

- Read exclusions and fine print

Choosing the right policy ensures you’re fully protected throughout your journey.

Planning Umrah with Peace of Mind

Travel insurance is not just an added expense - it’s a form of reassurance. When combined with professional travel arrangements, reliable accommodation, and on-ground support, it helps pilgrims perform Umrah with confidence and calm.

Online Umrah offers structured travel solutions that help pilgrims plan every aspect of their journey with clarity and support.

Begin your planning by exploring Umrah Packages designed for a smooth and spiritually fulfilling experience.

So, is travel insurance for Umrah worth it? Absolutely. While basic insurance comes with your visa, additional coverage offers protection against unexpected situations that could otherwise disrupt your pilgrimage.

By planning wisely, understanding your coverage, and choosing trusted travel services, you can ensure that your Umrah journey remains focused on devotion—not difficulties.

Leave a Comment

Your email address will not be published. Required fields are marked *